Visual Abstract Image

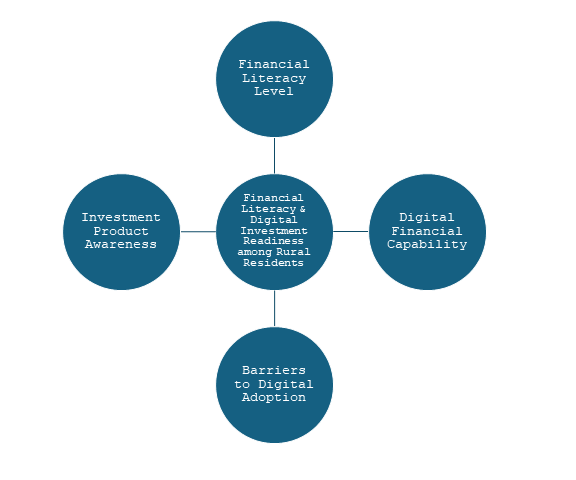

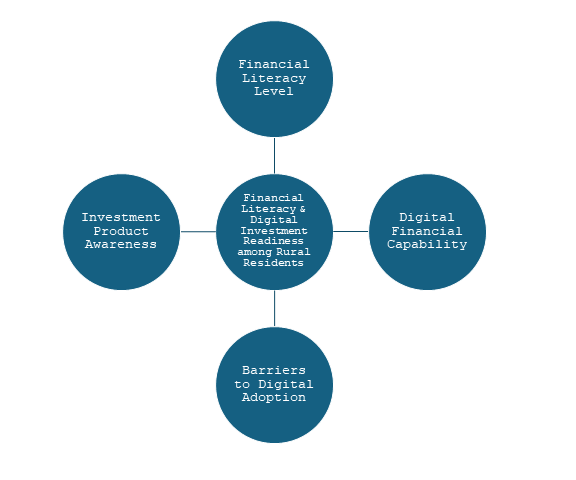

Objectives

- To assess the level of basic financial literacy related to money management concepts among rural customers in villages of Madhya Pradesh.

- To examine the level of awareness of formal investment products and schemes among rural households.

- To evaluate the digital readiness of rural customers for executing investment-related transactions.

- To identify technological, behavioural, and infrastructural barriers to the adoption of digital investment platforms in rural areas.

- To analyse the relationship between financial literacy and digital investment readiness among rural customers.

Issues Involved

- While many rural financial literacy programmes have been conducted, there is no strong evidence on whether these initiatives have led to actual digital investment participation by rural customers.

- Despite the launch of digital platforms such as E-LMS, mobile applications, and chatbots, user adoption remains low relative to rural outreach, indicating limited effective use of digital financial education tools.

- Uneven coverage of financial literacy programmes across states suggests disparities in rural financial awareness and digital investment readiness, including in Madhya Pradesh.

Team Lead

Dr. Mahipal Gadhavi

mahipal.gadhavi@nmims.edu